Computing overtime pay in the Philippines is straightforward once you know the right formula. Begin by identifying your regular hourly rate, then determine your overtime hours and apply the appropriate multiplier based on the day and time you worked.

Understanding how to compute overtime pay Philippines will help you ensure fair compensation for your extra hours. With the right approach and knowledge, you can easily calculate what you deserve, making your paycheck truly reflect your hard work. Let’s break down the steps together.

“`html

How to Compute Overtime Pay in the Philippines

Computing overtime pay in the Philippines can seem challenging, especially if you’re not familiar with the rules and regulations set by the Department of Labor and Employment (DOLE). This guide will break down everything you need to know about calculating overtime pay, including who qualifies, the different types of overtime, and how to calculate it step by step.

Understanding Overtime Pay

Before diving into the computation, it’s essential to understand what overtime pay is. Overtime pay is extra compensation for hours worked beyond the standard work hours. In the Philippines, the standard work hours amount to 8 hours a day or 48 hours a week.

Who is Eligible for Overtime Pay?

Not all employees qualify for overtime pay. Generally, the following groups are eligible:

- Employees who work in the private sector

- Hourly workers

- Employees engaged in activities covered by labor laws

However, some employees may be exempt from overtime pay, such as:

- Managers and supervisors

- Field personnel

- Employees in government service

- Those working in non-profit organizations

Types of Overtime Pay

When calculating overtime pay, it’s important to know the types of overtime rates applicable. The following types may arise:

Regular Overtime

Regular overtime refers to the extra hours worked on a normal working day. Employers typically pay this at 125% of the regular hourly rate.

Special Holiday Overtime

If you work on a special holiday, you will receive additional compensation. The computation for this is usually 130% of your regular hourly rate.

Regular Holiday Overtime

If you work on a regular holiday, your employer pays you 200% of your regular hourly rate for those hours.

Rest Day Overtime

Working on a rest day comes with a premium as well. You receive 130% of your regular hourly rate for these hours.

Calculating Overtime Pay

Now that you understand overtime pay and its types, let’s go through the steps to compute it accurately.

Step 1: Determine Your Regular Hourly Rate

To find your regular hourly rate, you can use this formula:

“`

Regular Hourly Rate = Monthly Salary / Number of Work Hours in a Month

“`

Typically, a month has around 22 working days. Hence, the total work hours in a month is:

“`

Total Work Hours = 22 days x 8 hours = 176 hours

“`

If you earn PHP 20,000 per month, your regular hourly rate would be:

“`

Regular Hourly Rate = PHP 20,000 / 176 hours = PHP 113.64

“`

Step 2: Identify Overtime Hours

Next, determine how many hours you’ve worked beyond the standard 8 hours. For example, if you worked 10 hours one day, your overtime hours would be 2 hours.

Step 3: Apply the Overtime Rate

Using your regular hourly rate, calculate your overtime pay according to the type of overtime.

– **For Regular Overtime (125%)**:

“`

Overtime Pay = Overtime Hours x Regular Hourly Rate x 1.25

“`

– **For Special Holiday Overtime (130%)**:

“`

Overtime Pay = Overtime Hours x Regular Hourly Rate x 1.30

“`

– **For Regular Holiday Overtime (200%)**:

“`

Overtime Pay = Overtime Hours x Regular Hourly Rate x 2.00

“`

– **For Rest Day Overtime (130%)**:

“`

Overtime Pay = Overtime Hours x Regular Hourly Rate x 1.30

“`

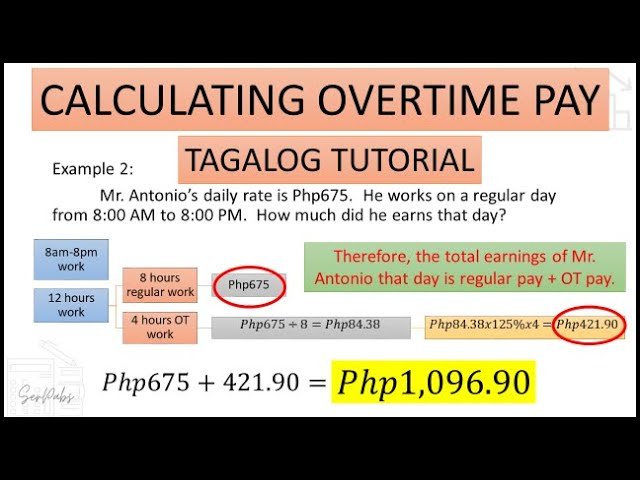

Step 4: Example Calculations

Let’s work through a few scenarios to clarify.

**Example 1: Regular Overtime Calculation**

– Monthly Salary: PHP 20,000

– Regular Hourly Rate: PHP 113.64

– Overtime Hours: 2 hours

Calculating Regular Overtime Pay:

“`

Overtime Pay = 2 hours x PHP 113.64 x 1.25 = PHP 284.10

“`

**Example 2: Special Holiday Overtime Calculation**

– Monthly Salary: PHP 20,000

– Regular Hourly Rate: PHP 113.64

– Overtime Hours: 3 hours

Calculating Special Holiday Overtime Pay:

“`

Overtime Pay = 3 hours x PHP 113.64 x 1.30 = PHP 443.37

“`

**Example 3: Regular Holiday Overtime Calculation**

– Monthly Salary: PHP 20,000

– Regular Hourly Rate: PHP 113.64

– Overtime Hours: 4 hours

Calculating Regular Holiday Overtime Pay:

“`

Overtime Pay = 4 hours x PHP 113.64 x 2.00 = PHP 454.56

“`

**Example 4: Rest Day Overtime Calculation**

– Monthly Salary: PHP 20,000

– Regular Hourly Rate: PHP 113.64

– Overtime Hours: 2 hours

Calculating Rest Day Overtime Pay:

“`

Overtime Pay = 2 hours x PHP 113.64 x 1.30 = PHP 295.64

“`

Important Considerations

When computing overtime pay, keep the following in mind:

Documentation

Always maintain accurate records of hours worked. This documentation helps prevent disputes regarding overtime payment and ensures transparency.

Company Policies

Some companies may have specific policies regarding overtime work. Always check your company’s policy manual for additional rules or rates.

Employment Agreements

Your employment contract may state specific arrangements regarding your overtime pay and hours. Always review your agreement to understand your rights.

Consulting with HR

If you have questions about your overtime pay, don’t hesitate to approach your Human Resources department. They can provide clarity on company policies and any related issues.

Potential Issues with Overtime Pay

Several common issues may arise concerning overtime pay. Awareness of these can help you navigate your rights effectively.

Payment Delays

Sometimes, you may encounter delays in receiving your overtime compensation. Promptly address this issue with your employer to ensure you receive your due wages.

Incorrect Computation

Mistakes can happen in computing overtime pay. If you believe there is an inconsistency, gather your records and discuss the matter with your HR department.

Disputes Over Eligibility

Disagreements may surface about whether you qualify for overtime pay. Familiarize yourself with labor laws to protect your rights.

Final Tips for Employees

Here are a few extra tips to keep in mind regarding overtime pay in the Philippines:

- Keep a log of your hours worked, including overtime.

- Understand your employment rights and the relevant labor laws.

- Communicate openly with your employer about any overtime hours.

- Stay informed about updates in labor laws affecting your pay.

Always remember that knowing how to compute and advocate for your overtime pay rights is essential. With the correct information, you can ensure that your hard work is rewarded accordingly.

In conclusion, understanding how to compute overtime pay in the Philippines is crucial for both employees and employers. By following the steps outlined in this guide, you can confidently manage overtime calculations, ensuring fair compensation for extra hours worked. Stay informed, keep accurate records, and don’t hesitate to seek help if you encounter problems along the way.

“`

PH Labor Law – How to Compute Overtime Pay (Ordinary Working Day)

Frequently Asked Questions

What is the standard workweek in the Philippines?

The standard workweek in the Philippines consists of 40 hours, typically spread over five days. Employees usually work eight hours a day. Any hours worked beyond this standard workweek qualify for overtime pay, which is mandated by labor laws.

How do you calculate the basic hourly rate for overtime?

To calculate the basic hourly rate for overtime pay, divide the employee’s monthly salary by 260, which represents the average number of working days in a year (assuming a 5-day workweek). This calculation gives you the employee’s hourly rate, which you can then use to compute overtime pay.

What is the overtime pay rate for holidays?

For overtime work performed on regular holidays, the pay rate increases significantly. Employers must pay the employee 200% of their basic rate for the first eight hours of work. For hours worked beyond the standard eight hours, the employee earns an additional 30% on top of the 200% rate.

Are there different rules for night shift overtime pay?

Yes, the Philippines has specific rules regarding night shift overtime pay. If an employee works between 10 PM and 6 AM, they should receive an additional 10% premium on their basic pay. If their work extends into overtime during these hours, the overtime pay should incorporate this night shift premium.

Can an employee refuse to work overtime?

Employees in the Philippines cannot generally refuse overtime work if it is a legitimate request by the employer and falls within the legal limits. However, employees may decline if the overtime work poses a health risk or violates their rights under labor laws. It’s advisable for employees to communicate their concerns with their employer.

Final Thoughts

To compute overtime pay in the Philippines, first identify the employee’s basic hourly rate by dividing their monthly salary by the standard number of working hours in a month. For overtime work, employers should pay at least 1.5 times the basic hourly rate for hours worked beyond the standard.

If an employee works on a rest day or holiday, the overtime rate may increase to double or more, depending on company policy or labor agreements.

Understanding how to compute overtime pay Philippines ensures fair compensation for extra hours worked while promoting a healthy work-life balance.